Explore the Archive

- Risk Notices Ltd

- Risk Notices SA

- Default Fund Notices SA

- Circulars

- Flash infos Bonds & Repos

- Flash infos Derivatives

- Flash infos Equities

- Flash infos Other

- Fixed Income Notices Ltd

- Legal Notices SA

- Membership Notices SA

- General Information

- General Member Meetings

- Press Releases

- SA Completion of Application Documentation

- SA Clearing Specifications

- SwapClear Legal Documentation

|

FIS and LCH.Clearnet launch clearing for Fertilizer Swaps

London, 30 September 2009

FIS, the derivatives broker and LCH.Clearnet Ltd (LCH.Clearnet) will launch an OTC clearing service for the fertilizer swap market on 16 October 2009 in a move that will increase transparency and liquidity and greatly reduce counterparty risk.

The global physical fertilizer market had an estimated annual turnover of $500bn in 2008 with some 1bn tonnes of raw materials and products traded annually. The addition of clearing will increase trading capacity, improve operational efficiencies and facilitate optional post-trade anonymity, making the product more appealing to participants from outside the industry – particularly financial institutions.

Initially, four swap products will be offered on cleared basis. These are: Yuzhnyy and Nola Urea, Tampa DAP and Nola UAN, representing the most liquid nitrogen and phosphate markets. More products will be introduced in due course. Fertilizer swaps can be traded standalone or combined with freight or other commodities for full risk management.

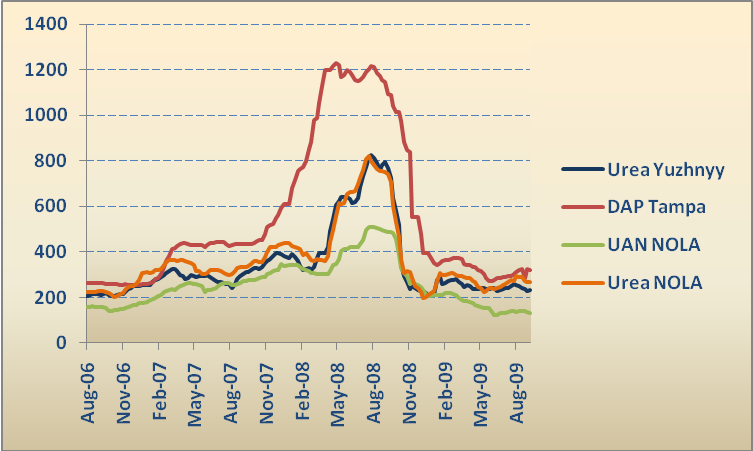

John Banaszkiewicz, Managing Director of Freight Investor Services said: “With prices over the last 12 months peaking at $850 for Urea NOLA and plunging to a spot level of $260 [see accompanying graph], fertilizer swaps are vital in managing risk against volatile price movements. These products have strong correlation with world grain and gas prices, which will attract more players into the market now that clearing has been introduced.”

John Banaszkiewicz, Managing Director of Freight Investor Services said: “With prices over the last 12 months peaking at $850 for Urea NOLA and plunging to a spot level of $260 [see accompanying graph], fertilizer swaps are vital in managing risk against volatile price movements. These products have strong correlation with world grain and gas prices, which will attract more players into the market now that clearing has been introduced.”

Henk Van Dalfsen, chief executive officer of Transammonia Fertilizer Division said: “This is an excellent opportunity for the industry. Clearing fertilizer OTC swaps will enhance its position among various commodities. It will bring new participants to the market and will help pave the way to more liquidity for those looking to hedge their exposure and for those trading fertilizer swaps in a portfolio of energy related products.”

Richard Sutherland, vice president of Mosaic said: “Mosaic has been trading fertilizer swaps for the past three years and now the availability of a cleared contract will enable us to protect the value of assets and will also result in improved transparency for the buyers and sellers, particularly beneficial to the producers.”

Isabella Kurek Smith, director, energy and freight at LCH.Clearnet said: “We are proud to be working with FIS to develop the cleared contract. Their industry expertise has strongly supported the development of clearing in this important and growing market. The service will bring the benefits of risk mitigation and reduction of counterparty risk to industry participants and our members. LCH.Clearnet is pleased to be able to launch this contract as a natural extension to our successful FFA clearing service, and we look forward to expanding our clearing services in the grain, freight and iron ore markets.”

To view the press release as a pdf click here.

For further information, please contact John Banaszkiewicz, Tel: +44 (0) 20 7090 1120 www.freightinvestor.com [email protected]

LCH.Clearnet

Rachael Harper, Tel: + 44 (0) 207 426 7175 [email protected]

Notes to Editors:

About the FIS fertilizer swap: The FIS Fertilizer Swap is a cash-settled paper trade settled against the Fertilizer Index, which is produced weekly and represents physical spot prices in the market. The FIS cash-settled swap allows a buyer and a seller (counterparties) to agree on a price in the forward market for a specific fertilizer product for a specified future period. There is no payment until settlement date and therefore no capital outlay and there is no delivery of physical product. The FIS fertilizer swap leverages a well-established and a growing client base which includes some of largest trading companies in the world.

About FIS: FIS was founded in October 2002 and is a leading brokerage house offering impartial and accurate risk management guidance and advice on the freight, iron ore, physical shipbroking and fertilizer derivative markets. The company is registered and regulated by the Financial Services Authority (FSA) in UK and MAS in Singapore.

About LCH.Clearnet: LCH.Clearnet is the leading independent clearing house group, serving major international exchanges and platforms, as well as a range of OTC markets. It clears a broad range of asset classes including: securities, exchange traded derivatives, energy, freight, interbank interest rate swaps and euro and sterling denominated bonds and repos; and works closely with market participants and exchanges to identify and develop clearing services for new asset classes.

A clearing house sits in the middle of a trade, assuming the counterparty risk involved when two parties (or members) trade. When the trade is registered with a clearing house, it becomes the legal counterparty to the trade, ensuring the financial performance; if one of the parties fails, the clearing house steps in. By assuming the counterparty risk, the clearing house underpins many important financial markets, facilitating trading and increasing confidence within the market.

Initial and variation margin (or collateral) is collected from clearing members; should they fail, this margin is used to fulfill their obligations. The amount of margin is decided by the clearing house’s highly experienced risk management teams, who assess a member’s positions and market risk on a daily basis. Both the soundness of the risk management approach and the resilience of its systems have been proven in recent times.

LCH.Clearnet is regulated or overseen by the national securities regulator and/or central bank in each jurisdiction from which it operates.