Explore the Archive

- Risk Notices Ltd

- Risk Notices SA

- Default Fund Notices SA

- Circulars

- Flash infos Bonds & Repos

- Flash infos Derivatives

- Flash infos Equities

- Flash infos Other

- Fixed Income Notices Ltd

- Legal Notices SA

- Membership Notices SA

- General Information

- General Member Meetings

- Press Releases

- SA Completion of Application Documentation

- SA Clearing Specifications

- SwapClear Legal Documentation

| Originating department: | Risk Management |

| Company Circular No: | LCH.Clearnet Ltd Circular No 2979 |

| Service Circular No: | Nodal Exchange 013 |

| Date: | 12 September 2011 |

| To: | All LCH.Clearnet Members |

Margining of contracts with negative or near zero prices

Background

All Nodal contracts are currently VaR-margined using a 257-day price history. There may be instances when the prices of these contracts become negative or close to zero. If this were to happen, the existing VaR methodology would produce an incorrect price return from a negative price as well as potentially generate excessive price returns from near zero prices.

New Solution

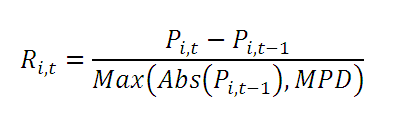

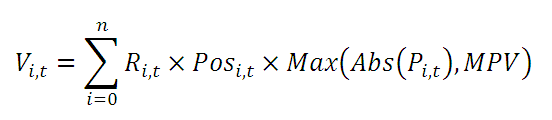

Given the above, LCH.Clearnet is implementing a new VaR margining methodology to deal with negative and near zero prices. Two additional parameters have been added: Minimum Price Denominator (MPD) and Price Threshold for VaR (MPV). These two parameters are implemented in the following way for the calculation of returns and VaR contribution:

For more detailed information on the methodology, please contact [email protected]