Explore the Archive

- Risk Notices Ltd

- Risk Notices SA

- Default Fund Notices SA

- Circulars

- Flash infos Bonds & Repos

- Flash infos Derivatives

- Flash infos Equities

- Flash infos Other

- Fixed Income Notices Ltd

- Legal Notices SA

- Membership Notices SA

- General Information

- General Member Meetings

- Press Releases

- SA Completion of Application Documentation

- SA Clearing Specifications

- SwapClear Legal Documentation

Risk Management - Ltd

The Clearing House needs to provide robust and prudent risk management in order to meet its overriding objective: to provide Clearing Members with a central counterparty of the highest quality and to safeguard the interests of the company's shareholders and contributors to its Default Funds.

For Ltd specific information select from the links on this page.

For Group risk management information, including an overview of LCH.Clearnet’s risk mitigation approach, default waterfall structure and history of default management, select the Group Overview link.

Risk classification

The LCH.Clearnet Risk Governance Framework identifies the following risk classifications under the remit of the Risk Management department.

- Latent market risk

- Sovereign risk

- Wrong way risk

- Concentration

- Counterparty credit risk

- Liquidity risk

- Settlement, payment and custody risk

- FX risk

- Business risk

- Operational risk

- Regulatory and compliance risk

- Business continuity

- Model risk

- Investment risk

- Default management

Policies are maintained covering all of these risk classifications.

Each policy identifies the high level principles and standards contained in the Risk Governance Framework and relevant regulation, and is supported by detailed annexes and procedural documentation which demonstrate how policy requirements are met.

All risk policies are reviewed at least annually by:

- Relevant ERCo sub-committee

- ERCo (Executive Risk Committee) – to give approval to submit to Risk Committee and Board

- Risk Committee – review and recommend to Board for approval

- Board - approval

- Regulators

Margin

Initial margin for all services is calibrated to be sufficient to offset any losses under normal market conditions incurred during the close-out period of a Clearing Member default, to a 99.7% confidence level. The percentage applied is agreed by the LCH.Clearnet Board and set out in the LCH.Clearnet Risk Governance Framework which is shared with the competent authorities.

Additional margins are levied to cover position concentrations, wrong way risk, illiquid positions and Clearing Members with lower credit standing or capital support.

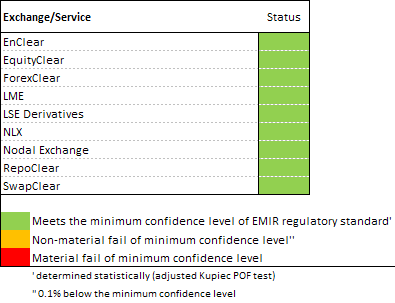

Margins are backtested daily for each Clearing Member and sub account against this confidence level, and reported monthly at clearing service level to regulators and at least quarterly to the Risk Committee. The table below provides service level margin backtesting results.

Please refer to the following section on margin models and their governance for further information.

Margin backtesting results by service

Period: 18 months to March 2014

Margin models & governance

Model inventory

An up-to-date inventory of all models is maintained. All models are reviewed by an independent model validation team annually. Material changes and all new models are also subject to an independent validation.

The inventory and validation status are reviewed annually by the Board.

Model performance is assessed daily through portfolio backtesting.

The margin models applied to each service are identified in the sections below.

Margin models – analytical

| Market | Model type | Margin method used | Look-back period for the risk measure | Holding period | Frequency of parameter review |

|---|---|---|---|---|---|

| Nodal | VaR / Expected shortfall | Historical simulation | 1 year | 2 days | Daily |

| SwapClear | VaR / Expected shortfall | Historical simulation with volatility scaling | 10 years | 5 days for GCM/SCM

7 days for FCM | Daily |

| ForexClear | VaR / Expected shortfall | Historical simulation with volatility scaling | 10 years | 5 days for House

7 days for FCM | Daily |

| RepoClear | VaR / Expected shortfall | Historical simulation with volatility scaling | 10 years | 5 days | Daily |

| NLX | VaR / Expected shortfall | Historical simulation with volatility scaling | 5 years | 2 days | Daily |

| EquityClear | VaR / Expected shortfall | Historical simulation | 1 year | 2 to 7 days, depending on liquidity class | Daily |

Margin models – empirical

| Market | Model type | Margin method used | Look-back period for the risk measure | Holding period | Frequency of parameter review |

|---|---|---|---|---|---|

| LME | Empirical model | London SPAN | 1 year | 2 days | Monthly |

| EnClear | Empirical model | London SPAN | 1 year | 2 days

7 days for FCM | Monthly |

| LSE Derivatives | Empirical model | London SPAN | 1 year | 2 days | Quarterly |

Other resources

Default Funds and stress testing

Mutualised Default Funds, segregated for each service, are calibrated monthly and tested daily to be sufficient to withstand the default of the two Clearing Member groups giving rise to the largest losses calculated under scenarios of extreme conditions. Default Funds have both a floor and a cap to ensure minimum levels of protection and avoid over-mutualisation.

Clearing Member contributions are subject to a minimum amount and re-calibrated monthly in proportion to the risk they introduce.

A proportion of CCP capital is placed ahead of non-defaulting Clearing Member contributions in the waterfall.

The waterfall structure for each of the service specific Default Funds can be viewed via the following link:

LCH.Clearnet Ltd Default Waterfall.

Clearing Members with large stress losses over margin are charged additional margins where the cap would otherwise be exceeded and intra-month if credit related tolerances are reached.

Analysis of stress testing and Default Fund adequacy is reviewed by the Risk Committee at least quarterly.

Collateral

Cash and securities eligible to cover margin liabilities and Default Fund contributions are restricted to those with low credit, liquidity, and market risks, including cash in major currencies.

Haircuts are applied to securities to cover market, credit, concentration/liquidity, wrong way and foreign exchange risks, calculated to a 99.7% confidence level over a 3 day horizon based on a 10 year look-back period.

Types of collateral currently acceptable, their haircuts and other conditions can be viewed by selecting the following link:

LCH.Clearnet Ltd does not have a right of use of margin or Default Fund contributions collected within the meaning of Article 2(1)(c) of Directive 2002/47/EC of the European Parliament and of the Council of 6 June 2002 on financial collateral arrangements, and therefore does not provide for such right in its operating rules.

Default management

LCH.Clearnet CCPs have detailed default management plans and procedures consistent with the Default Management Policy.

These provide clear criteria for when to call a Clearing Member into default and the steps to be followed in order to manage such a default event.

The policy also requires frequent default management testing or ‘firedrills’, at both product and cross product levels.

Please use the link below to view the LCH.Clearnet Ltd Rulebook, which outlines the relationship between LCH.Clearnet and its Clearing Members, covering the rights and obligations of each during a Clearing Member default.

Default Porting Consent Forms

In the event of the default of a Clearing Member, a client may port to a Backup Clearing Member by ensuring that the Backup Clearing Member provides the following completed documents to LCH.Clearnet Limited:

Consent to act as Backup Clearing Member

Client Consent to transfer portfolio to Backup Clearing Member

Investment risk

Investment risk arises through the investment of Clearing Member cash posted as collateral for margin liabilities and Default Fund contributions. Investments are made in such a way as to ensure that principal is protected and liquidity is available when needed, even under stressed conditions.

To deal with this:

- All investment counterparties meet minimum credit standards according to an internal credit assessment

- All investments meet minimum credit criteria, and must be explicitly Government guaranteed

- The average term of the investment portfolio is consistent with regulatory standards

- Unsecured investments are limited to <5% of the cash portfolio and must be no more than one week in term

Credit risk and membership

LCH.Clearnet Group CCPs review the counterparty risk of its Clearing Members and other counterparties by continually monitoring market indicators and financial information.

An Internal Credit Scoring (ICS) framework assesses clearing counterparty credit risk using the following inputs:

- Financial analysis

- External ratings and market implied ratings

- Expected default frequency

- Operational capability assessment

The rating model is validated at least annually and the rating scale is continuously monitored for performance.

A minimum credit score is set for joining a clearing service and the same entry requirement is applied to existing Clearing Members looking to join another service within LCH.Clearnet.

Increased margins are applied when the credit score deteriorates below the entry level. Other actions may include reduced credit tolerances and forced reduction of exposures.

More detailed information on membership, including entry criteria, the application process and current membership, for each of the Group CCPs can be viewed here.

Risk Governance

Matters concerning significant risks faced by the Group’s CCPs are addressed by a Risk Committee appointed by the relevant subsidiary board.

Chaired by an Independent Non-Executive Director (INED), membership of the Risk Committee is comprised of representatives of the CCP’s users and their clients, and other INEDs. Further representatives from each CCP’s user community and senior CCP executives attend the meetings as risk experts in a non-voting capacity.

Internally, an Executive Risk Committee (ERCo) reports to the Board Risk Committees and the Executive Committee. Chaired by the Group Chief Risk Officer, membership of the ERCo comprises heads of each clearing business as well as the subsidiary CROs and senior group risk management and compliance executives.

ERCo sub-committees separately address credit risk, market risk and asset & liability management issues. These sub-committees review all relevant matters prior to presentation to the ERCo.

Risk Committee Terms of Reference and current membership are available to view here.

A chart of the Risk Governance Committee structure is available to view here.

Member and client risk disclosure

The key risk connected with being a Clearing Member (or client of a Clearing Member) of any LCH.Clearnet clearing service will be risk of financial loss. Some of the associated risk scenarios are described below:

- Clearing Member default – non-defaulting Clearing Members are at risk of losing Default Fund contributions and further Default Fund assessments. Each service also has a process to allocate further losses to Clearing Members of that service. In the event of service closure, replacement costs could be incurred. Clients of a defaulting Clearing Member may also incur losses or disruption to their activities as a result of the default management process. For further information please refer to the Default Rules

- Extended Member Liability – risk arising due to the default of the Clearing Member’s PPS bank while funds are held on the account of LCH.Clearnet at the PPS bank. For further information please refer to http://www.lchclearnet.com/risk_management/ltd/pps/pps_concentration_activities.asp and to Section 3 of the Procedures.

- Default (insolvency) of LCH.Clearnet –For information on the applicable rules please refer to Regulations 45 and 46 of the General Regulations and Regulations 25 and 26 of the FCM Regulations.

- In the event of market disorder, impossibility of performance, trade emergency or in cases of force majeure, Regulations 37 and 38 of the General Regulations may apply and Clearing Members could suffer losses as a result of invoicing back of contracts or other action taken by LCH.Clearnet. LCH.Clearnet is also entitled, under Regulation 40, to meet obligations in alternative currencies.

Disclaimer: The above description is a summary of the key financial risks to which Clearing Members and/or clients of LCH.Clearnet may be exposed. This list is not exhaustive and Clearing Members and clients should review the Rulebook and carry out their own risk analysis.

Rulebooks

The CCP Rulebooks outline the relationship between LCH.Clearnet and Clearing Members, covering the rights and obligations of each, including rules governing the following:

- default management procedures

- access to the CCP

- the contracts concluded by the CCP with Clearing Members and, where practicable, clients

- the contracts that the CCP accepts for clearing

- any interoperability arrangements

- the use of collateral and Default Fund contributions, including the liquidation of positions and collateral and the extent to which collateral is protected against third party claims

LCH.Clearnet Ltd, LCH.Clearnet SA and LCH.Clearnet LLC are distinct legal entities with their own rulebooks and processes, each available to view on this website.

The LCH.Clearnet Ltd Rulebook is linked below.